Birches Group closely monitors labor markets that are making headlines worldwide, keeping you updated on trends and developments.

In Myanmar, a Southeast Asian nation brimming with hope for democracy, a brutal reality continues to grip the country. A February 2021 military coup d’état overthrew opposition leader Aung San Suu Kyi and her elected government—returning Myanmar to authoritarian rule, shattering years of progress toward democracy, and plunging the country into a relentless power struggle.

While the world’s attention has focused on the political turmoil, mass displacement, and human rights abuses, another tragedy unfolds. Three years into military rule, the junta has once again extended the state of emergency for another six months. Sadly, Myanmar’s people continue to endure the worst of the crisis.

This headline article goes beneath the surface of violence and unrest in Myanmar, exploring how the coup has devastated the country’s economy.

Shifting tactics: Junta faces renewed resistance

Since seizing power in February 2021, Myanmar’s military junta has faced unwavering opposition. The Global Center for the Responsibility to Protect reports that hundreds of thousands of citizens have joined peaceful protests and strikes against military rule. The International Crisis Group also reports, “Some of the country’s ethnic armed groups have gone on the offensive, and new forms of armed resistance by civilian militias and underground networks have emerged.”

The past five months have seen a shift in both the military’s tactics and the nature of resistance. The government has been rapidly losing ground to rebel forces in several regions of Myanmar. In late October 2023, an alliance of three ethnic armed groups launched a coordinated attack against the regime, posing the strongest challenge since the 2021 coup.

Reuters reports that Myanmar’s junta is now “facing the fiercest threat to its power since seizing control.” Collective campaigns targeting the military have emerged across the country, and the military’s control has been shaken, its resources strained, and the morale of its soldiers undermined.

As it battles an unprecedented alliance of opponents while being weakened by internal dissent and defections, the military regime has escalated its crackdown on civilians. The junta has stepped up its increasingly brutal methods like mass arrests, forced displacements, and aerial bombardments.

Analysts from the United States Institute of Peace, however, say that “There is simply no way back for an enfeebled and stretched junta that is rapidly losing its ability to control the public. Its airstrikes and arson attacks on civilian populations have only served to deepen the public’s commitment to resist.”

This interplay between shifting tactics and renewed resistance paints a grim picture of Myanmar’s current situation, where the cost of the power struggle is borne by the increasingly desperate civilian population. Amid the escalation of the fighting, the United Nations (UN) reports that over 2.5 million people have been displaced by the armed conflicts.

Yun Sun, a nonresident fellow of the Brookings Institution, comments, “Some Myanmar watchers believe that the balance of power may shift sufficiently to change the tides within the country or the military government.” Even though there have been some significant and strategic gains for ethnic armed organizations who have been working with increased cooperation, the conflict is ongoing with no obvious end in sight, says the UN Office for the Coordination of Humanitarian Affairs (UN OCHA) in its Myanmar Humanitarian Needs and Response Plan for 2024. The Economist Intelligence Unit further notes that while “the junta’s control has weakened substantially and now controls about 30-40% of Myanmar’s territory, it is unlikely to fall.”

Kyat in crisis: Currency devaluation and eroding purchasing power

The situation in Myanmar, fueled by the military junta’s desire to maintain power, has triggered a domino effect of consequences affecting the lives of citizens. The political turmoil has translated into a harsh reality of economic hardship, social unrest, and deepening poverty.

Sanctions imposed by the international community, aimed at pressuring the junta, have crippled Myanmar’s financial system. Some countries have also suspended development funds and imposed embargoes, among other measures. While intended to isolate the military regime, these sanctions have choked the local economy.

The World Bank notes that Myanmar’s economy has shrunk since the COVID-19 pandemic and the military coup, with economic activity remaining weak and constrained. In fact, it estimates the economy in 2023 to be 30% smaller than it might have been in the absence of the pandemic and coup.

Trade and investment have dwindled. In its investment climate statement on the country, the United States (US) Department of State says, “The regime’s ongoing violence, repression, and economic mismanagement have significantly reduced Burma’s commercial activity.”

The US State Department expounds that the Central Bank of Myanmar “has imposed severe foreign exchange restrictions that limit commercial activity and severely limits access to US dollars.” In its most recent economic monitor, the World Bank notes the presence of multiple exchange rates and a widening gap between the official and parallel market rates.

Rising inflation adds another layer of hardship. Inflation and conflict are driving up the prices of essential goods, such as food and fuel, leaving vulnerable households in distress, says the UN OCHA in its January 2024 update on Myanmar. Additionally, a recent World Bank survey found that about half of the surveyed households reported a decrease in income over the past year. Oxfam adds that over 20% of the population still lives below the poverty line, pushing people at risk deeper into desperation.

What our Market Monitor reveals

In the wake of Myanmar’s ongoing political turmoil, concerns arise about its impact on the labor market. To understand this complex and multi-layered issue, we reviewed data from our Market Monitor reports for the past six months. Looking back at the period between 1 August 2023 and 1 February 2024, we wanted to shed light on how the crisis is affecting Myanmar’s labor market.

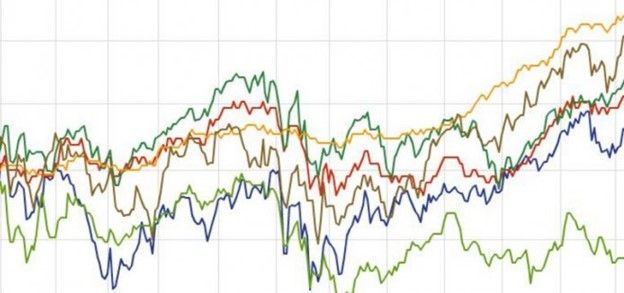

Our Market Monitor reports show a significant increase in volatility and exchange rate movement since 1 December 2023, when Myanmar reentered our list of markets to watch at Level 3. Level 3 (out of six levels of volatility) suggests rapidly evolving market conditions and an exchange rate movement of 40% or more in six months. It also implies multiple salary reviews and revisions should be considered among the comparators of our salary surveys in Myanmar.

In the 15 December 2023 edition of our report, Myanmar’s volatility level quickly rose to Level 4, remaining high since then. Level 4 suggests a sudden, unexpected social/economic event, a currency devaluation of 50% or more in six months, and a disjointed and unclear survey comparator response. Myanmar’s exchange rate movement sharply increased from 40% on 1 December 2023 to 63.3% on 15 December 2023. However, it has slightly decreased to 62.9% since 1 January 2024. As of 15 February 2024, our latest edition, the exchange rate movement over the past six months has further declined to 61.4%.

How Birches Group can help

The situation in Myanmar is still fluid, and its future uncertain. We at Birches Group urge readers to pay close attention to the country’s political climate. The ramifications of Myanmar’s economic crisis extend far beyond news headlines. Understanding the current situation and its socioeconomic impact is crucial for organizations operating and managing their workforce in Myanmar.

Staying informed requires ongoing monitoring. We encourage you to subscribe to our Market Monitor reports for bimonthly updates and analysis. Our latest edition (15 February 2024) focuses on Myanmar as a case study for developing special measures amid volatility.

Moreover, registering for our salary surveys will equip you with the most recent data on compensation and benefits in Myanmar, allowing you to maintain responsible HR practices during these grim times.

Birches Group is committed to providing you with the latest insights and resources to navigate this crisis. By staying informed and using reliable data, we can minimize the negative impact of this ‘forgotten emergency’ on the lives of Myanmar’s citizens. Subscribe to our Market Monitor and register for our compensation and benefits surveys today.

References:

- https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099121123082084971/p5006630739fd70a00a66c0e15bf7b34917

- https://reliefweb.int/report/myanmar/myanmar-humanitarian-needs-and-response-plan-2024-december-2023-enmy

- https://reporting.unhcr.org/operational/situations/myanmar-situation

- https://www.brookings.edu/articles/operation-1027-changing-the-tides-of-the-myanmar-civil-war/

- Birches Group Market Monitor reports (1 August 2023 to 15 February 2024)