To effectively manage salaries, organizations need a compensation policy that will guide them during the scale design exercise. A compensation policy outlines the organization’s approach to selecting and refining their relevant comparator sample, determining their target market position, identifying which benefits to assess and include in their pay package, as well as determining the frequency of salary scale reviews. There is a misconception that salary survey data alone, can give organizations what they need to manage compensation. But in Birches Group, we believe that having a strong compensation policy, coupled with good survey data, will steer organizations in the right direction toward the answers that they need. Without a compensation policy, it will be difficult for organizations to know where to start, or what to do with the survey data that they have.

When establishing your compensation policy, a few things need to be considered, beginning with identifying one or more surveys of high quality as your source of market data. Be sure you fully understand each survey’s methodology and approach so you can easily aggregate the results in your market comparison.

Once you have your salary survey data, the next step to designing your salary scale is to establish a refined comparator sample comprised of employers important or comparable to you. While having a robust salary survey may sound ideal in providing an extensive range of data, not all survey participants will be relevant. Your compensation policy should clearly identify the number of comparator organizations to be selected and the criteria they must meet to be included in your market comparison.

Building a Compensation Policy, Examples of Criteria to Consider:

- Talent competitors (those you recruit talent from and lose talent to)

- Industry peers

- Organizations of the same size or in the same geographic location

- Other leaders in your market outside of your sector

Choosing the right target comparators is key to be able to narrow down the bigger survey data to a group of more significant employers that share qualities parallel with your organization. Additionally, organizations need to keep in mind that participants in a survey can change each year, with new ones added and old ones dropped. The key is having consistent criteria that ensure, even with a changing survey sample, your selected comparator group is consistent and still sufficient to meet your requirements.

Once you have selected your target comparators or target market, you will need to identify your target market percentile or target market position. Selecting your target percentile would depend on how competitive you want to be against your chosen market, while also taking your organization’s budget into consideration. Your organization’s compensation policy should define the ideal market position it requires to reach the talent it needs to recruit and retain. Further, the compensation policy should also identify if all levels in the organization will have the same market position or will be tailored to each level.

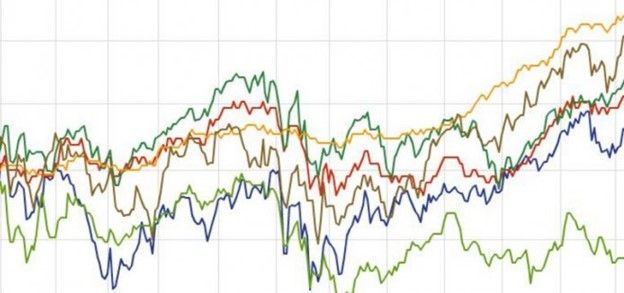

If your organization is facing challenges to recruit or retain talent, you should reassess your target market position and adjust it to ensure your organization is positioned competitively against your chosen market. Sometimes recruitment and retention issues are limited to specific grades or bands. While some organizations may use the same target market position for all grade levels, labor markets are not uniform and do not move in a linear fashion. Certain grade levels can move faster due to high demand, hot skills, or other considerations. Organizations can choose a more competitive target market position for job levels where these talent challenges exist.

In our article, It Starts with Jobs, we explained that there are four labor markets, not just one. In Birches Group’s Community™ approach, these are called the four job clusters. Different grade levels in the labor market are grouped into these four job clusters and movement from cluster to cluster can be very distinct, where jobs at higher grade levels often move much quicker than jobs at the lower levels. It is important for employers, when comparing their salaries to the external market, to recognize this when deciding which grade levels to adjust as it allows for a more refined approach that is targeted to the organization’s needs, rather than simply applying an across-the-board adjustment.

Now that you have identified your target market comparators and target market position, your compensation policy should also outline the benefits that will be included in your compensation package. If you are looking to introduce benefits into your compensation package or change your existing benefits package, you’ll need to consider the following:

Some Things to Consider if You’re Looking to Introduce Benefits into Your Compensation Package:

- Locally Mandated Benefits – The first place to start is by checking if there are any benefits, whether cash or in-kind, that are prescribed by law. Different countries have different mandatory benefits; some may have mandatory bonuses or allowances, while others may have mandatory contributions toward pension or medical coverage.

- Market Practice – When assessing your benefits package, it also helps to know the common practice in the local market. While some practices may not be mandatory, if they are provided by most employers in the market, it may be a competitive requirement to follow the market. Your survey sources should be able to provide detailed information on all types of benefits.

- Benefits that Promote Desirable Behaviors – Some employers use benefits to promote desirable behavior among their staff. For example, a performance bonus to reward achievement and encourage good performance, and seniority bonus or subsidized loans to promote retention.

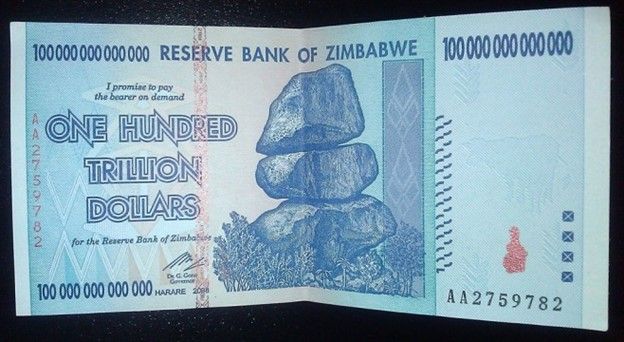

Finally, your compensation policy should also identify how frequently your salaries will be reviewed. In Birches Group, we recommend that organizations review their salaries and benefits every year to ensure that their salary scale is adaptable to changing operational realities in terms of budget and resources, and evolving team structures, as well as ensure that their scales are aligned to their target market position and is able to adapt to changing market trends.

It is important for organizations to have well-articulated pay policies in place that will not only guide how they develop their salary structure and manage compensation, but also provide the framework for forming strategies around recruitment and retention of their staff, proving this to be a valuable HR tool. Birches Group is ready to assist in establishing the appropriate compensation policy that can address your organization’s needs. Contact us to learn more.

Want to know if your existing compensation practices have the elements of a good compensation program or if there are areas that could use some improvement? Take our quick Compensation Program Assessment Quiz to know your score!

Bianca manages our Marketing Team in Manila. She crafts messaging around Community™ concepts and develops promotional campaigns answering why Community™ should be each organization’s preferred solution, focusing on its simplicity and integrated approach. She has held various roles within Birches Group since 2009, starting as a Compensation Analyst and worked her way to Compensation Team Lead, and Training Program Services Manager. In addition to her current role in marketing and communications, she represents Birches Group in international HR conferences with private sector audiences.

Follow us on our LinkedIn for more content on pay management and HR solutions.